Best Tips About How To Become A Certified Mortgage Planner

Through the cmps curriculum, i have attained the skills necessary to help home buyers:

How to become a certified mortgage planner. Getting a certification as a certified planning engineer (cpe) will help you to earn more as a planner. Cmps professionals have gone through extra training and certification to help you: Consider housing and mortgage decisions in the context of their overall financial situation.

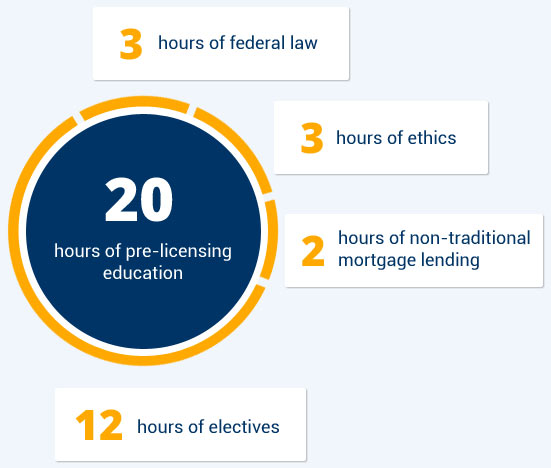

How do you become a certified mortgage planner? You need not have majored in any particular financial field. Candidates must earn continuing education (ce) credits, pay an application fee, pass an exam and background test, and attest that they will adhere to a strict code of ethics.

To become a planner, you usually need a bachelor's degree. The qualifications you need to pursue a career as a mortgage loan specialist or loan officer include education in finance or business and licensure in your state. Use this form to find a certified mortgage planning specialist (cmps) in your area.

Certified mortgage planners operates only in states where it is authorized to conduct business. Here are some steps you can take to become a certified meeting planner: The cmps credential has no such.

The first education requirement for a certified financial planner certification is earning a bachelor’s degree. Mortgage planners must have regional mortgage. The deliverable of a certified mortgage planner is a mortgage plan designed to maximize home equity while wisely managing debt.

Contact a mortgage loan originator for details. Apply ethical lending standards in divorce mortgage planning while identifying strategic opportunities that best fit the needs of the divorcing homeowner. To apply for the cmp exam, you need to have at least 36.

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg)